Your superannuation, or ‘super’ is money put aside by your employer over your working life for your retirement.

Super is important because the more money you save, the more money you have for retirement.

Super is only able to be withdrawn in certain circumstances such as retiring, or turning 65, which ultimately works in your benefit as Superannuation accounts compound, meaning the more money in your account, the more money it will generate – so it’s usually a good idea to keep your money in there!

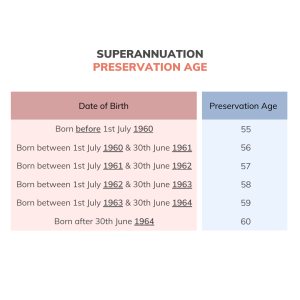

What is the Super preservation age and when can I access my super?

The Super preservation age, is the age you have to be in order to retire and access your super. The preservation age will change depending on when you were born.

Superannuation Conditions of Release

Besides reaching the preservation age and retiring, there are specific conditions of release that will allow you to access super, such as:

- Compassionate grounds

- COVID-19 early release

- Permanent incapacity

- Severe financial hardship

- Super less than $200

- Temporary incapacity

- Temporary or non-resident leaving Australia permanently

- Terminal medical condition

- You are 65 years old (even if you haven’t retired)

- You reach preservation age and retire

What are super contributions?

Super contributions are monies that your employer puts into your superannuation account. You can also make your own contributions through salary sacrifice or contributions from your after-tax income. There are limits called ‘caps’ on the amount you can contribute each year to your super. If you contribute more than $27,500 (including contributions), you will have to pay additional tax.

Speak with our in-house super specialist, Debbie, if you need further assistance with this.

Are Superannuation contributions taxed?

Super contributions are taxed at a flat rate of 15%.

However, there are some exceptions:

- If you earn less than $37,000, your tax is paid into your superannuation account, due to the Low-Income Super Tax Offset (LISTO)

- If your income and super contributions combined equal in excess of $250,000, you have to pay an extra 15%

- If you make contributions form your after-tax income (non-concessional contributions), you don’t have to pay contributions tax

Are Super withdrawals tax free?

When it comes to super withdrawals, the amount you get taxed depends on how you withdraw it. Ultimately, due to each persons financial situation being different, each financial situation will react differently.

Super Income Stream

This is a withdrawal method made through small frequent withdrawals of your super over time, almost like paying your own salary.

Over 60 = usually tax free

Under 60 = most likely have to pay tax

Lump Sum Withdrawals

If you’re over 60 and withdraw a lump sum from a taxed super account, you won’t pay any additional tax. Whereas, if you withdraw from an untaxed super account (like a public sector fund), you may pay tax.

If you’re under 60, you will avoid paying tax if your withdrawal is under the low rate threshold of $225,000. If you withdraw over the $225,000 you will be taxed 17% plus the Medicare levy (or your marginal tax rate if it is lower).

If you haven’t reached your preservation age, you will pay 22% plus the Medicare levy (or your marginal tax rate if it is lower).

Tax Free Super Withdrawals

You can claim tax free Superannuation when you reach your preservation age – maximum 60 years of age.

When looking at withdrawing from your super, we recommend speaking with your accountant/financial advisor first. Contact us today!